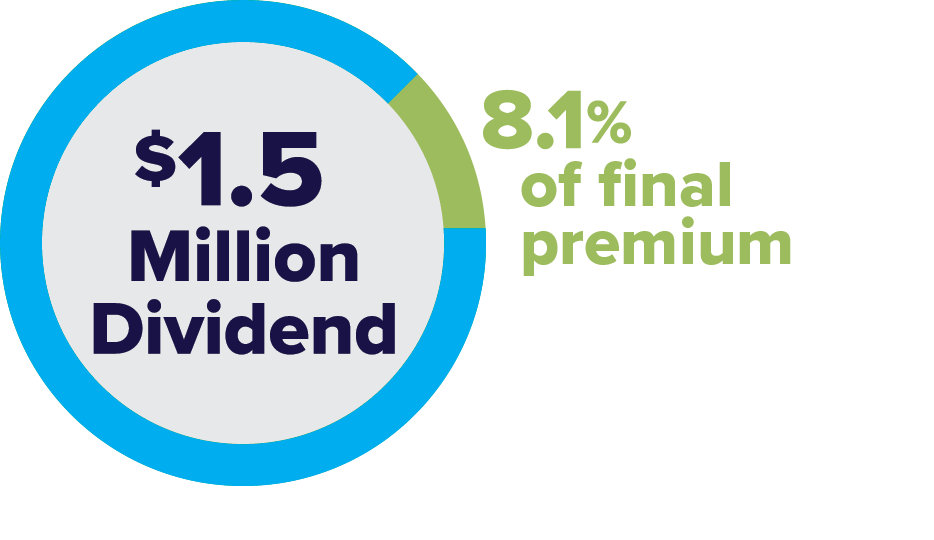

Lawyers Mutual returned a dividend of 8.1% of the final premium for the 14th consecutive year.

The following information summarizes the financial position and operations of Lawyers Mutual Liability Insurance Company of North Carolina for the two years ending December 31, 2024. This information is based on statutory accounting principles codified by the National Association of Insurance Commissioners and subject to any deviations prescribed or permitted by the North Carolina Department of Insurance. An electronic copy of the Company’s 2024 Annual Statement is available upon request.

Lawyers Mutual’s financial health strengthened further in 2024, posting an Underwriting Gain and experiencing continued support from Investment income. As in 2023, the Company experienced lower reported claims compared to other recent years, but severity spiked in 2024 and continues a trend over the last three years. Even with inflation declining from record levels, the Company expects severity to continue to be a concern. The Company’s financial results in 2024 and strong surplus position allowed us to declare a significant policyholder dividend.

FINANCIAL RESULTS

Lawyers Mutual recorded a Net Underwriting Gain of $2,149,671 and $2,749,171 for 2024 and 2023, respectively, on Direct Premiums Written and Assumed of $18,867,866 and $19,062,348. While Direct Premiums decreased slightly in 2024, Net Premiums Earned increased slightly after the impact of a reinsurance contract commutation. No similar commutation occurred in 2023. The increase in Claims Incurred was due mainly from increased severity in the 2024 Report Year, partially offset by favorable development on prior Report Years. The increase in Underwriting Expenses follows an expected return to pre-pandemic levels. Net Investment Gain continued to be strong in 2024 due to the current elevated interest rate environment. As a result, Lawyers Mutual recorded Net Income of $6,587,345 and $5,810,259 for 2024 and 2023.

Admitted assets totaled $162 million at year end as Policyholder Surplus rose to $121 million, an increase of 9.2%, keeping pace with claims inflation and providing protection against economic and other potential risks, including those associated with the investment markets. Strong underwriting and investment performance, including distributions from subsidiaries, provided sufficient growth in policyholders’ surplus and enabled the Company to declare and pay an 8.1% policyholder dividend.

Please download the accompanying summary financial statements for more information.