We are pleased to report that we had a successful 2024 fiscal year. Our claims were in line with previous years, and of those claims closed, 75% were closed with no loss payments.

Lawyers Mutual – A mission to help. People who care. Protection that counts. In 2024, Client Services expanded our community engagement and spearheaded disaster relief in the wake of Hurricane Helene.

The Enterprise and Operational Risk Management Team operates largely in the background with tasks such as maintaining the technology and security programs, supporting other departments through business analytics, and developing and testing policies and procedures to maintain operations through unexpected events.

In 2024, Underwriting focused on innovation and adding technologies to meet the needs of our insureds and improve how they do business with us.

At Lawyers Insurance, our customers place a lot of trust in us to provide solutions to their benefit and insurance needs.

In 2024, operations of LM Consulting & Services folded into the parent company to consolidate risk management and law practice management services.

LM Title completed a strong second half of 2024 to produce a pre-dividend/pre-tax profit 221% higher than FY2023. We set records for Sales, Total Revenue, and Gross Profit.

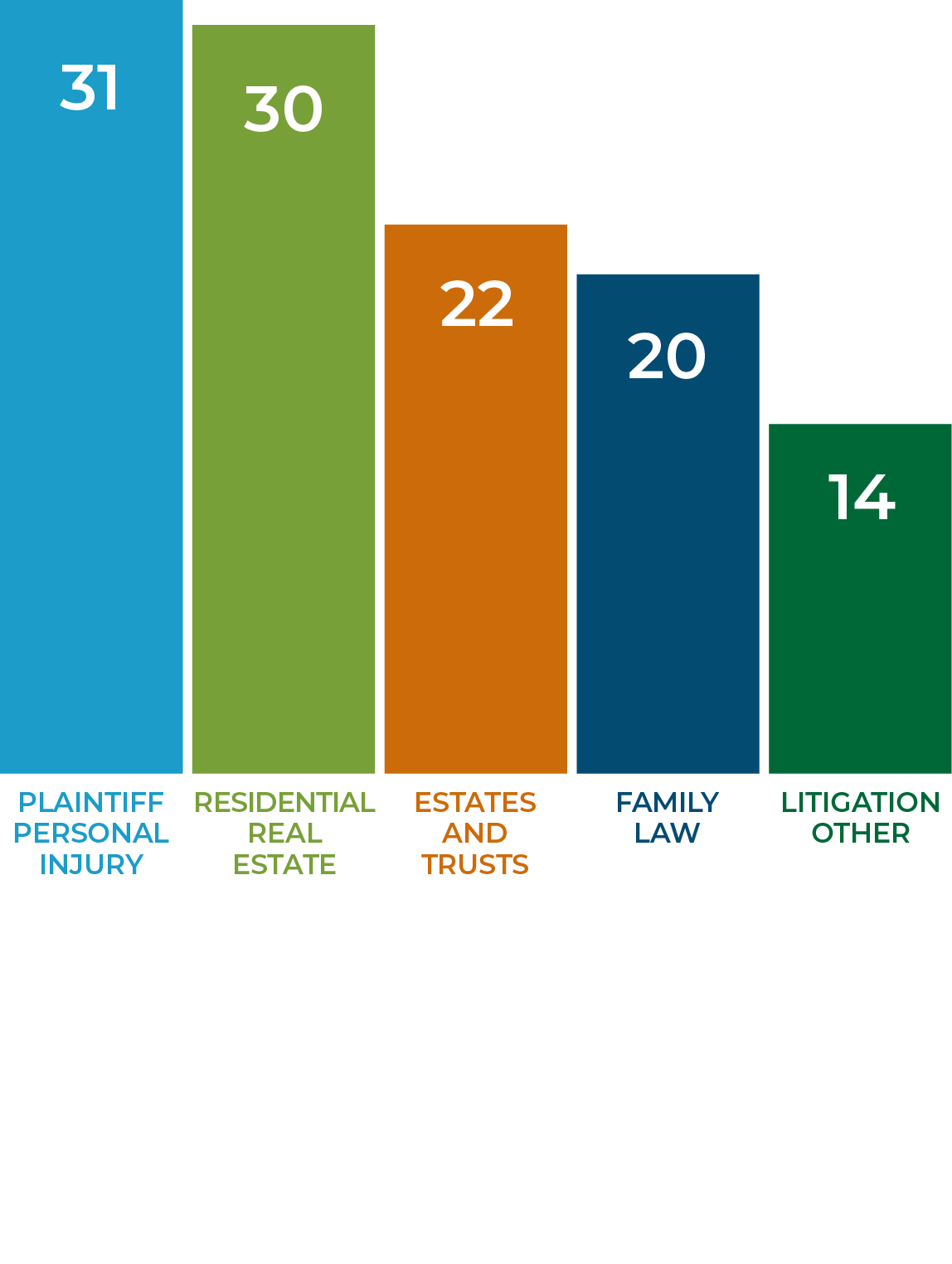

For 2024, the Claims counts in the top 5 areas of practice were: Plaintiff Personal Injury: 31, Residential Real Estate: 30, Estates and Trusts: 22, Family Law: 20, and Litigation Other: 14.

For the fifth year in a row, we had the most claims reported in Plaintiff’s Personal Injury. Missed deadlines continue to breed the most errors. The most common litigation errors we see are missed statutes of limitations, lapsed alias and pluries summons, mistakes with underinsured/uninsured motorist cases and missed discovery deadlines. We did see an uptick in cyber and fraud claims in 2024 compared to the past few years.

Our year end claim count was 249, slightly up from year end 2023 at 245.

Of the claims closed in 2024, 75% were closed with no loss payment. The remaining 25% were closed with a loss payment.

In 2024, Lawyers Mutual’s robust community engagement reached insureds in 20 counties/judicial districts across North Carolina including Buncombe, Carteret, Catawba, Chatham, Craven, Davidson, Durham, Edgecombe, Forsyth, Guilford, Iredell, Mecklenburg, Moore, Nash, New Hanover, Pitt, Rowan, Rutherford, Wake, and Wilson. From CLE geared towards claims prevention, tech tips, and emerging ethics to general practice support to event sponsorships, our activities supported a host of legal organizations across North Carolina as listed below.

The Enterprise and Operational Risk Management Team operates largely in the background with tasks such as maintaining the technology and security programs, supporting other departments through business analytics, and developing and testing policies and procedures to maintain operations through unexpected events.

We understand privacy and information security is important to you and we work to keep our systems and your information protected. We also share tips and lessons learned that may be helpful in your technology journey through live and on-demand CLE’s and website content. Over the past year we have seen cyber criminals expanding the monetization of compromised accounts, creating businesses focusing on certain aspects such as compromised credentials, phishing programs, bugs in code that create “back doors” into organizations, and even SMS broadcast tools such as those facilitating the toll road texts so many have received in the past few months – and then selling or licensing those to others who try to compromise accounts. The expansion of “artificial intelligence” and tools that allow for more natural sounding communications, voice cloning, and even video cloning create additional challenges for us all. It is more important than ever to take steps as simple as making a phone call to verify an email or text is legitimate before opening an attachment or link and utilizing multifactor authentication to help keep all of us safe.

Underwriting has been focused on innovation and adding technologies that meets the needs of our insureds and improves how they do business with us. In 2022, we launched our online policy portal and mobile application allowing our insureds to:

In 2024, we created on an online reissue application.

Other underwriting accomplishments in 2024 include:

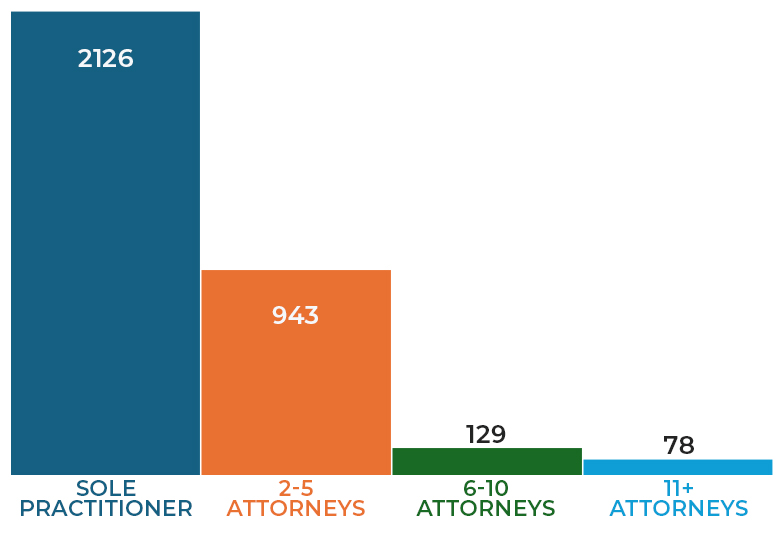

As the trusted malpractice insurance provider in North Carolina, we continued to support small law firms with 2,126 policies issued to sole practitioners and 943 policies issued to law firms of 2 to 5 attorneys.

At Lawyers Insurance, our customers place a lot of trust in us to provide solutions to their benefit and insurance needs. That places a big responsibility on us to repay that trust, and we take that responsibility very seriously. Firms and individuals participating in the NCBA Health Benefit Trust depend on us to help pay for their healthcare needs, some during the most difficult times of their lives. Our team has a deep well of experience in all a lawyer or law firm needs to protect their practice, their office and their cyber presence. We seek to serve our customers and earn their trust each day.

In 2024, operations of LM Consulting & Services folded into the parent company to consolidate risk management and law practice management services. The mission of the Lawyers Mutual Risk & Practice Management department is to assist insureds throughout the life of the modern law practice: law firm startup, strategic growth and planning, technology innovations, compensation planning, path to partnership, and succession planning.

HIGHLIGHTS OF 2024

Law Firm Consultations. 2024 saw the launch of free consulting as an added benefit to our insureds. Erik Mazzone and Camille Stell offered three free hours of consults to insureds in the areas of law firm startup, practice management, marketing, technology, compensation, path to partnership, succession planning and law firm winddown.

In 2024, we spoke with 340+ insureds via individual law firm virtual consults. Approximately one-third of the consults centered on technology issues, one-third on practice management issues (other than technology) such as marketing or process improvements, and one-third on issues relating to retirement and succession planning.

Risk Management Hotline. This resource has been available since the introduction of Lawyers Mutual’s risk management services more than thirty years ago. Insureds can call and speak with risk management professionals or claims attorneys about risk issues such as disaster planning or handling red flag clients. Following the natural disaster of Hurricane Helene, we offered a virtual disaster planning CLE due to the increased risk management inquiries from our insureds across the state.

HELP. Handling Emergency Legal Problems or HELP sprung into action over a decade ago. In the event of the unexpected death or disability of a law firm owner, Lawyers Mutual can assist law firms in triage of sudden emergency situations. The best preparation is to have a disaster plan in place, but if there is no plan, Lawyers Mutual can guide a firm through those initial days and help bring order to chaos.

On-demand CLE Platform. In 2023, Lawyers Mutual launched our on-demand CLE platform. That year our insureds viewed 427 hours of on-demand CLE programming. In 2024, growth spiked 29% with insureds viewing 549 hours. In 2025, we will be increasing our on-demand library significantly with new CLE videos and learning opportunities.

Speaking Engagements, CLEs, Publications. We continue to deliver impactful content on topics that are important to legal professionals. With more than 50 speaking engagements, 50+ articles, risk management alerts, white papers, and risk management practice guides, education continues to be a cornerstone of our mission.

2024 Law Firm Management Conference. In December, we hosted a virtual practice management conference with 118 attorneys and 29 paralegals and staff in attendance. The conference was well received and will be offered again in 2025.

We enjoy collaborating with our insureds and encouraging them in their journey. In a world where change takes place lightning fast, Innovation in your law office is more important than ever.

LM Title completed a strong second half of 2024 to produce a pre-dividend/pre-tax profit 221% higher than FY2023. We set records for Sales, Total Revenue, and Gross Profit. Total Revenue numbers were boosted by significant increases in Earned Interest and 1031 Fees/Interest. To summarize, we ended very strongly, after a slow start.